The S&P BSE Sensex and NSE Nifty 50 indexes plunged for a second straight session and were on track to post biggest single-day decline in over nine months after the government proposed to increase the minimum public

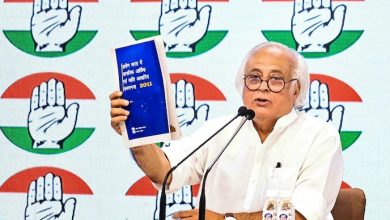

shareholding in listed companies and to raise the tax incidence for foreign portfolio investors and high net-worth individuals in its Budget. “I have asked SEBI to consider raising the current threshold of 25 per cent to 35 per cent,”

Finance Minister Sitharaman said while presenting the first Budget in Prime Minister Narendra Modi’s second term in Parliament on Friday. The Sensex fell as much as 847 points to 38,666 in afternoon deals, and the NSE Nifty 50

index slumped 268.5 points to slide below the crucial psychological level of 11,600.

Here are 10 things to know:

1. Auto and banking shares were among the worst performers in today’s session amid broad-based selling pressure.

2. At 1:12 pm, the Sensex traded 682.03 points – or 1.73 per cent – lower at 38,831.36 while the Nifty was down 217.60 points – or 1.84 per cent – at 11,593.55.

3. “Higher tax incidence proposed in the Budget for foreign portfolio investors and high net worth individuals is spooking the markets,” AK Prabhakar, head of research at IDBI Capital, told NDTV in a telephonic conversation. “The

proposal to increase minimum public shareholding for all listed companies in Budget is also impacting the markets negatively,” he added.

4. Selling pressure was broad-based as all the sector gauges compiled by National Stock Exchange struggled with losses, led by a 5.5 per cent drop in the Nifty PSU Bank index. The Realty, Auto, Bank, Financial Services, Media

and Private Sector Bank gauges also fell between 2 and 3 per cent each.

5. Experts also said the new tax implications on listed companies are not in favour of investors. “The government has also proposed a 20 per cent tax on buy back of shares by the listed companies. The tax was earlier restricted to

unlisted companies and with the introduction to tax share buy back, investors felt that the tax changes are not investor friendly,” Naveen Wadhwa of Taxmann told NDTV.

6. Selling pressure was broad-based as all the sector gauges compiled by National Stock Exchange struggled with losses, led by a 5.5 per cent drop in the Nifty PSU Bank index. The Realty, Auto, Bank, Financial Services, Media

and Private Sector Bank gauges also fell between 2 and 3 per cent each.

7. Market breadth was extremely negative as 1,431 shares declined on the BSE, against 252 that advanced.

8. Mid- and small-cap shares also faced selling pressure with the Nifty Midcap 100 Index and Nifty Smallcap 100 indexes falling 2.55 per cent and 2.27 per cent respectively.

9. ONGC, Bajaj Finance, Indian Oil, State Bank of India, Larsen & Toubro, Grasim Industries, NTPC, Tata Motors, Bharat Petroleum, Maruti Suzuki, ICICI Bank and Eicher Motors were among the losers, down between 2.77 per

cent and 4.64 per cent.

10. On the flipside, Yes Bank, HCL Technologies, Bharti Infratel, TCS and Tech Mahindra were among prominent gainers.