Government approves pension and insurance reforms

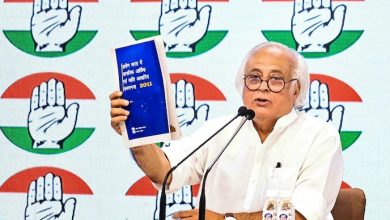

New Delhi: In a bid to restore the investors’ confidence in economy, the Union cabinet on Thursday approve the 26 per cent Foreign Direct Investment in Pension and increased the FDI Cap in insurance upto 49 percent. However these reforms will face a tough fight in parliament.

The steps followed big-ticket policies unveiled last month, including hiking diesel prices and inviting in foreign supermarkets, aimed at fending off a cash crunch and reviving growth, which has slowed to its slowest pace in nearly three years.

Those reforms helped drive up India’s markets in recent weeks, and the latest moves added to the positive sentiment and could boost interest in a forthcoming sale of shares in state-owned companies.

Most of India’s 24 insurance companies have lost money in the past decade, hit by restrictions on foreign holding and by regulatory changes.

Singh faces a tough fight to win parliament’s approval for more foreign investment in the economy, especially with two state elections looming and after an outcry over the decision to allow foreign supermarkets into the retail sector.

The pension and insurance bills have been proposed for nearly a decade. Unlike last month’s measures, they need to be approved by parliament, where the coalition government is in a minority after its largest partner pulled out in anger at last month’s reforms.

The cabinet also signed off on a shareholder-friendly bill to make corporate management more accountable, which would overturn a half-century old law.

Giving some hope to the government, the normally obstructive opposition Bharatiya Janata Party (BJP) said it was waiting for further details but was not totally opposed to the latest reforms.